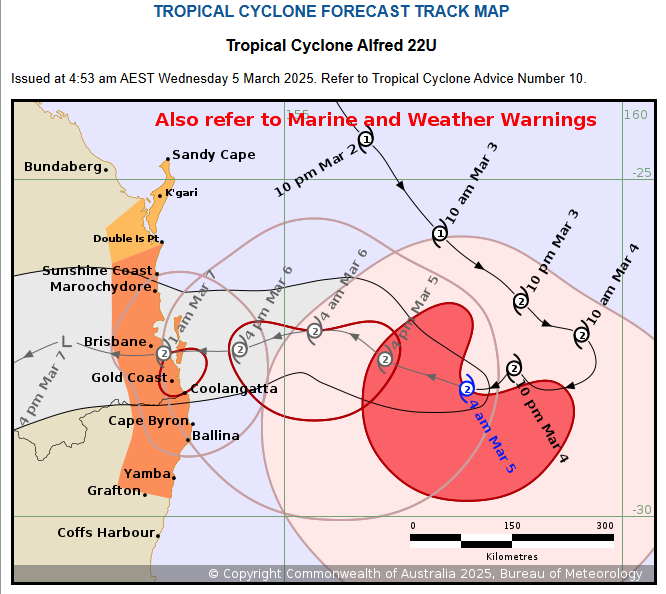

The ATO is Not All Sunshine and Rainbows

Have you received a letter or notice from the Australian Taxation Office (ATO) with a big coloured band across the top? Did you know that

the ATO uses coloured warning notices as part of its compliance efforts to encourage taxpayers to meet their tax obligations. These

“rainbow” notices are designed to communicate varying levels of urgency and seriousness regarding your tax situation. Here's a general

breakdown of the colours and their meanings:

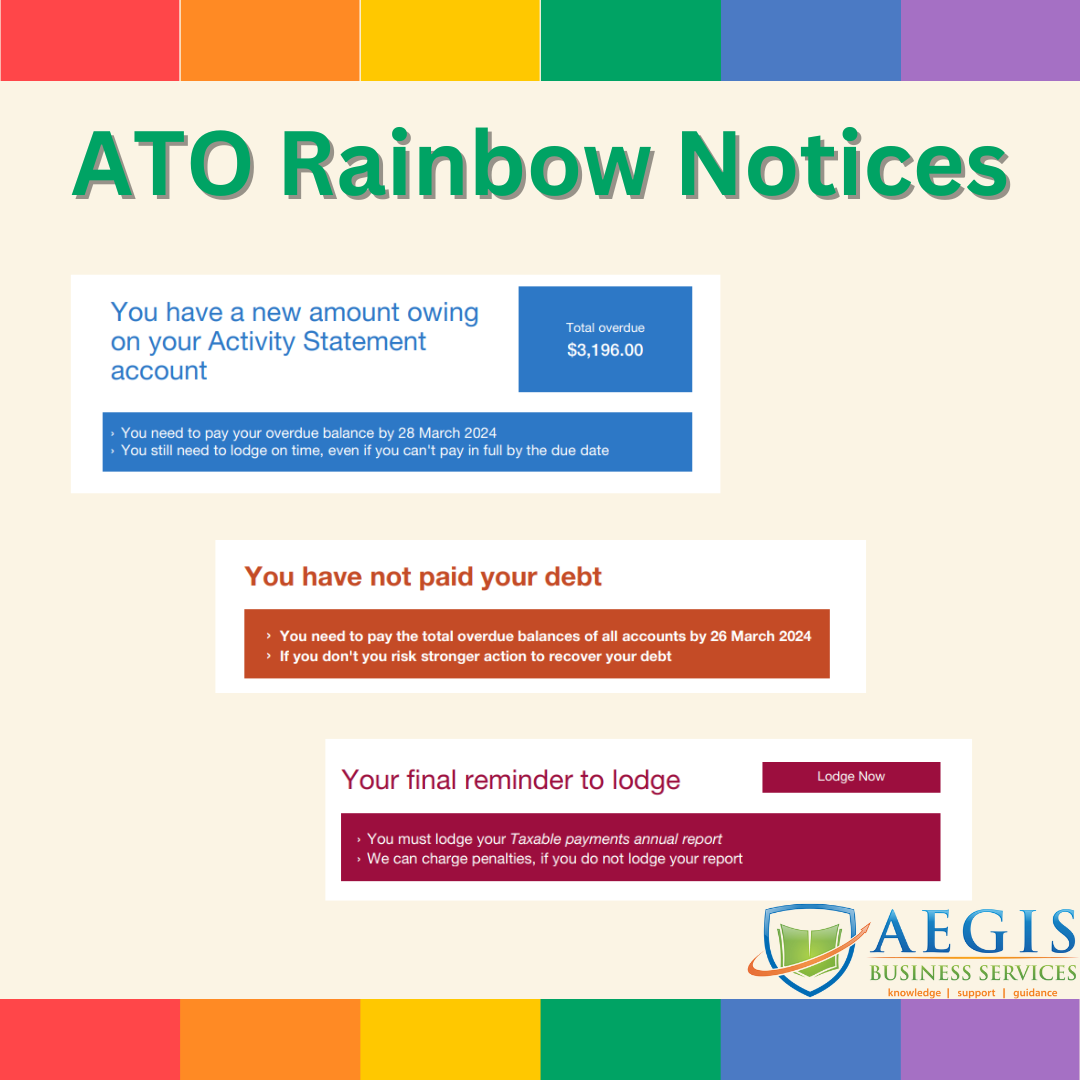

Blue Notices: These are the initial communication from the ATO. Blue notices are sent to taxpayers who have missed a deadline or failed to meet a certain obligation. They serve as a warning that corrective action is needed to avoid further consequences. These notices often provide specific instructions on what needs to be done to rectify the situation. Although they are usually not indicative of any imminent compliance action, these blue letters should not be ignored. Either action to clear the debt or lodge the outstanding return; or open up communication lines with the ATO for a payment plan, or lodgement deferral.

Orange Notices: Orange notices indicate a higher level of urgency. They are typically sent to taxpayers who have repeatedly failed to meet their tax obligations or who are at risk of facing serious consequences, such as fines or legal action, if they do not take immediate action to address their tax situation. Do not ignore – Action now.

Red Notices: Red notices are the most serious and indicate that the recipient is at imminent risk of facing severe consequences for non-compliance. This could include fines, penalties, or legal action. Red notices are typically sent when previous warnings have been ignored, and urgent action is required to avoid further escalation. Do not ignore – Action Immediately.

The use of a rainbow of warning notices by the ATO is intended to provide clear communication to taxpayers about the seriousness of their tax situation and the potential consequences of non-compliance. It's important for recipients to take these warnings seriously and to address any issues promptly to avoid further problems with the tax authorities. Regular communication with your registered tax agent is important, particularly when the rainbows begin to appear.

.png)