My software has bank feeds, why do I need to do a bank reconciliation?

Many software solutions these days have automatic bank feeds, so why do we still need to do an old-fashioned bank reconciliation?

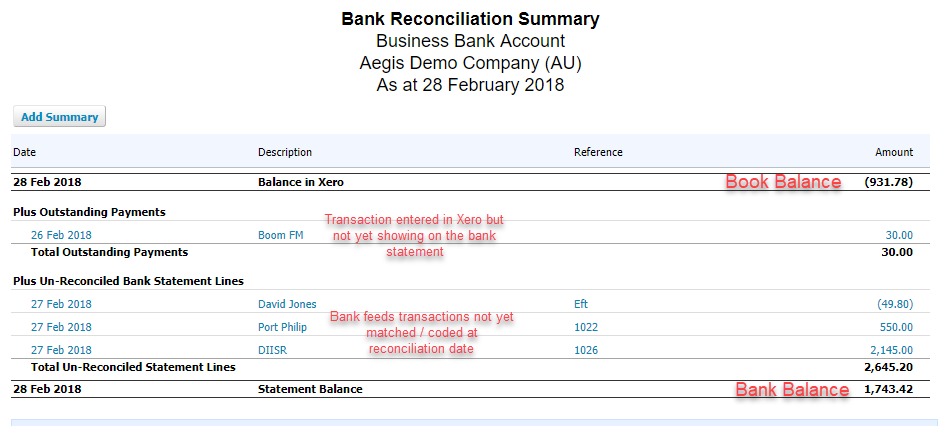

Firstly, what is a bank reconciliation? The process called “bank reconciliation”, “bank rec”, or “reconciling a bank account” essentially compares the bank account balance at a certain point in time showing in the software (called the “book balance”) and the actual balance in the bank account (called the “bank balance”). In an ideal world these two amounts will be the same, but in reality, often they are not. The purpose of the bank reconciliation where the book balance does not agree with the bank balance is to identify the reasons it is different, and if valid, list them out and show the calculation which explains the difference between the two balances. A bank rec is also a way to find errors in the data and correct them before the data is relied on to make cash flow and/or business decisions. Beware of software which uses the term “bank reconciliation” or “reconcile” for the process of matching bank feed transactions to entered transactions. This process is not the final step of a bank reconciliation.

I have bank feeds, so why do I need to check the bank balance? Although a fantastic time saver, bank feeds are not 100% perfect, and the operators are human. Every once in a while, feeds might not get pushed into the software, or are duplicated, or the bookkeeper makes a coding error. In some of our future blogs we will go through some of these examples, and how to fix them.

In our some of our upcoming blogs we will explain many of the valid and invalid reasons the book balance might not agree with the bank balance. A common question is “Why is my bank rec out?” Our upcoming blogs will give you some examples.

.png)